Introduction

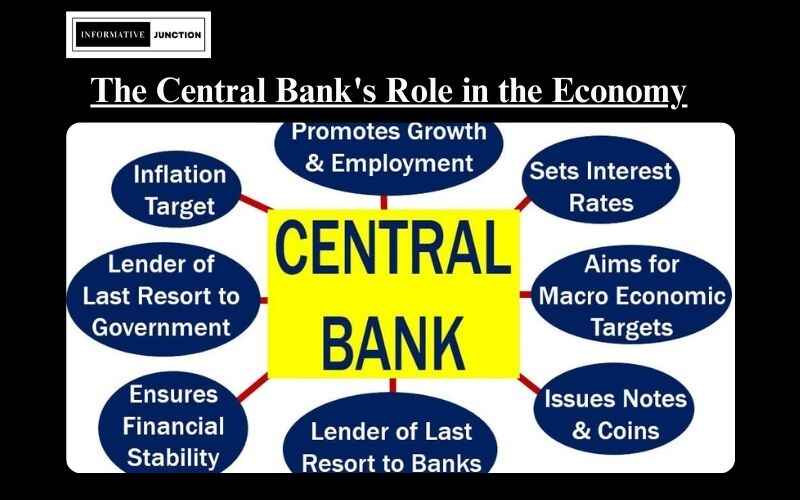

In the intricate machine of an economy, the central bank serves as the engine, driving monetary policy, managing currency, and maintaining financial stability. While the activities of central banks can often seem opaque and detached from everyday life, they impact everything from the cost of mortgages to the price of goods in the supermarket. With that in mind, let’s delve deeper into understanding the roles of a central bank and how they help shape the economies we live in.

1. Monetary Authority: Control Over the Money Supply

The Creation of Money: The central bank controls the creation of money in an economy. This function is particularly crucial in maintaining price stability and managing inflation, which affects the purchasing power of consumers and businesses alike.

Implementation of Monetary Policy: Central banks implement monetary policy to control the money supply and interest rates, using tools like open market operations and discount rates. This ability to expand or contract the money supply gives them significant influence over economic activity and the rate of inflation.

2. Financial Stability: Safeguarding the Economy

Banking Supervision and Regulation: Central banks have the authority to regulate and supervise commercial banks. They ensure that banks follow financial regulations and manage risks effectively. This oversight helps maintain trust in the banking system and prevent bank failures that could lead to economic crises.

Lender of Last Resort: In times of financial instability, central banks act as the “lender of last resort” by providing emergency funds to financial institutions. This function helps prevent the collapse of the banking system during a financial crisis.

3. Preserving the Financial System’s Stability

Ensuring Financial Stability: Central banks have a critical role in promoting the stability of the financial system. They monitor financial markets to detect and mitigate risks, such as asset bubbles and systemic failures.

Implementing Prudential Policies: They implement prudential policies to reduce the risk of financial instability. These policies include capital requirements, liquidity requirements, and stress testing for banks.

4. Management of Foreign Exchange Reserves

Control Over Foreign Exchange Reserves: Central banks manage the country’s foreign exchange reserves, which consist of foreign currencies, bonds, and other assets. These reserves are used to stabilize the value of the national currency and manage balance of payments.

Influencing Exchange Rates: By buying or selling foreign currencies, central banks can influence the exchange rate of their own currency. This function is vital in controlling inflation, managing the country’s exports and imports, and maintaining financial stability.

5. Government’s Bank

Bank to the Government: Central banks also serve as the government’s bank, managing its accounts, issuing debt, and implementing fiscal policies.

Implementing Fiscal Policy: While fiscal policy is typically the purview of the government, central banks often play a role in implementing these policies, especially during times of economic crisis.

6. Provider of Economic Statistics and Forecasts

Economic Research and Data: Central banks collect, analyze, and publish a vast array of economic data. These data provide valuable insights into the state of the economy and guide decisions on monetary policy.

Forecasts and Policy Analysis: Central banks use economic data to make forecasts and conduct policy analysis. This research is crucial in shaping monetary policy and managing the economy.

7. Role in Promoting Economic Growth

Promotion of Economic Growth: Through their monetary policies, central banks play a vital role in promoting economic growth. By lowering interest rates, for example, they can stimulate economic activity and encourage investment and consumption.

Managing Inflation and Unemployment: Central banks strive to maintain a balance between managing inflation and promoting growth. They aim for low and stable inflation, which can help foster a healthy business environment and reduce unemployment.

Conclusion

The role of a central bank in an economy is complex, multi-faceted, and crucial. As the key authority guiding monetary policy, preserving financial stability, and managing economic growth, central banks help create the conditions for economic prosperity. Understanding the functions and impact of a central bank is vital for anyone interested in the mechanisms that underpin our economies. As the world economy continues to evolve, central banks will remain at the forefront of navigating financial and economic challenges, making their role as relevant as ever in the 21st century.

Connect with Informative Junction

Click Here if you want to read more Interesting Blogs.